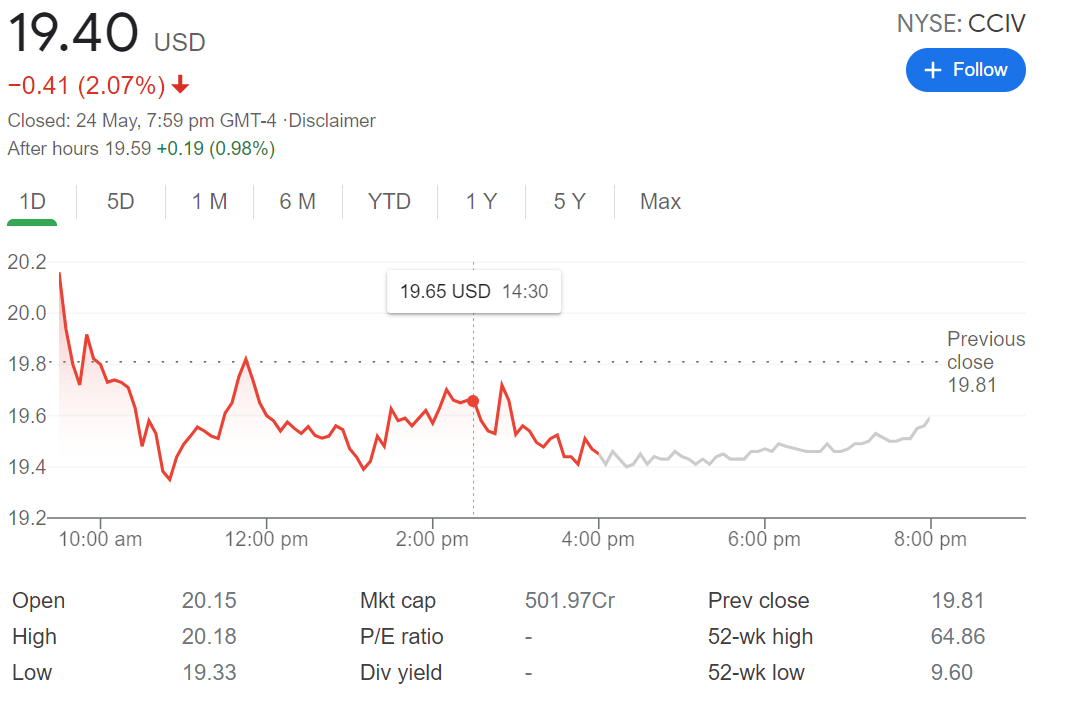

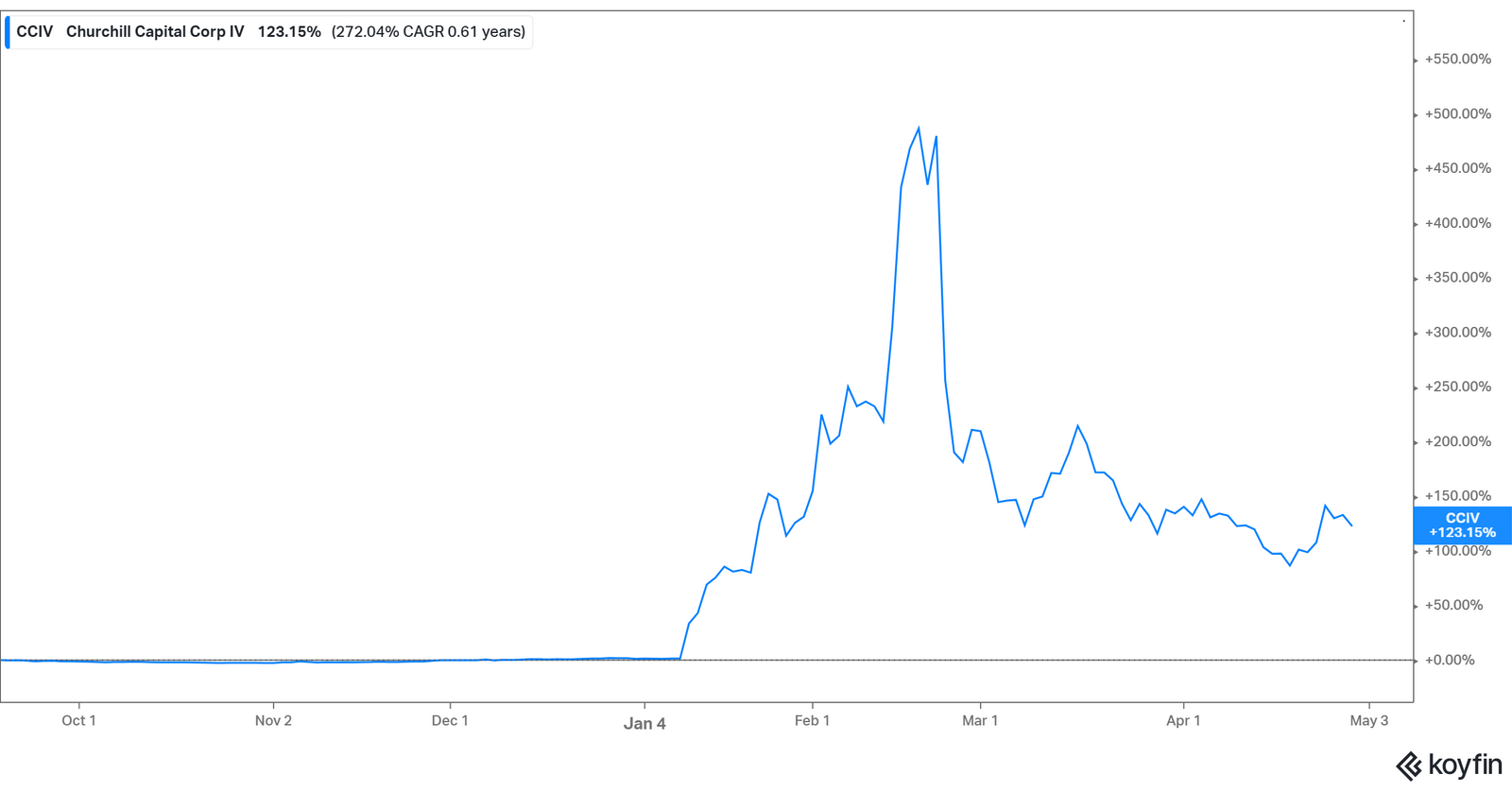

While the SPAC and electric vehicle spaces can be extremely volatile, an investment in Churchill Capital Corp. As of 2021, Lucid Motors has 2,000 employees, many with past experience in the automotive industry. Later that year, the company opened up a $700 million manufacturing facility in Arizona. In 2019, Lucid Motors received an investment of more than $1 billion from the Saudi Arabia Public Investment Fund. Lucid Motors was founded in 2007 and began developing its first vehicle - the Lucid Air - last year. While this is a sharp sell-off, this deal had been rumored for a while, and it may be a classic sell-the-news reaction. The merger deal valued California-based EV maker Lucid Motors at around $12 billion. After the market closed on February 22, Churchill Capital announced it will merge with electric vehicle company Lucid Motors.įollowing the merger announcement, CCIV stock declined by nearly 50% to a low of $30 per share. After pricing its July 2020 IPO at $10 per share, CCIV exploded to an all-time high of over $60 in February 2021. Our top picks for the best brokerages to start your search.Īlmost every SPAC stock has exploded to the upside, and Churchill Capital Corp. Once the order is filled, your shares of CCIV will show up in your account. Simply hit buy to send your order to your broker. Now that you have opened a brokerage account, decided how many shares to buy, and settled on the best order type to use, it’s now time to execute your trade. It’s usually a good idea to use limit orders when buying shares in a volatile stock such as CCIV. Market orders allow for a quicker entry into a position, while limit orders provide traders with much more control over their risk. Use a limit order if you are willing to delay buying shares until the price reaches your pre-set price point. Use a market order if you want to buy shares of CCIV immediately and at the prevailing National Best Bid and Offer (NBBO) price. There are numerous order types, and each has its pros and cons depending on the individual investor and the investment opportunity. Now that you have decided how many shares of CCIV to buy, you need to decide what order type to use. Once you have considered these factors and settle on an amount of shares to buy, start looking for a good entry point.

It may also be important not to buy too many shares of CCIV and consider setting a stop-loss in case the stock declines rapidly. Investing more than a few percent into a single stock is risky, especially when that stock is a high-flying SPAC. Some factors to consider include your age and time horizon, your net worth and your appetite for risk. Once you have your own brokerage account opened up, you next need to decide how many CCIV shares you want to buy.

LUCID CCIV STOCK FREE

You could end up with bonus trading funds or even free stocks.

Another thing to consider are any perks or promos offered by potential brokers. If you want to practice before risking your own money, select a brokerage that offers paper trading. Once this is done, it should be far easier to choose the best broker for your unique needs. Consider your investing experience and future goals to narrow your list of the best brokers. Very few brokers still charge commissions for trades, so you should be able to buy shares of CCIV with no additional fees.

The first step to buying shares of CCIV is to pick a brokerage.

0 kommentar(er)

0 kommentar(er)